As one of the most important characterization parameters of nano powder, particle size directly affects the physical and chemical properties of the powder, and then affects the performance of the final product. Therefore, its detection technology is an important tool for industrial production and quality management, and plays an irreplaceable role in improving product quality, reducing production costs, and ensuring product safety and effectiveness. This article will start from the principle and compare three common methods for powder particle size detection: electron microscopy, laser particle size analysis, and X-ray diffraction line width method, and analyze the advantages, disadvantages, and applicability of different particle size testing methods.

1、 Electron microscopy method

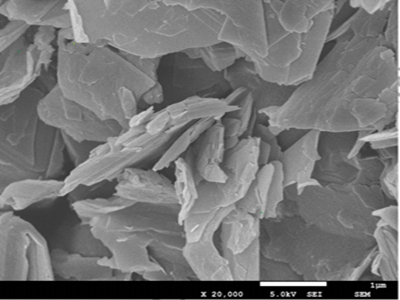

Electron microscopy is a high-resolution particle size measurement technique, mainly divided into transmission electron microscopy (TEM) and scanning electron microscopy (SEM).

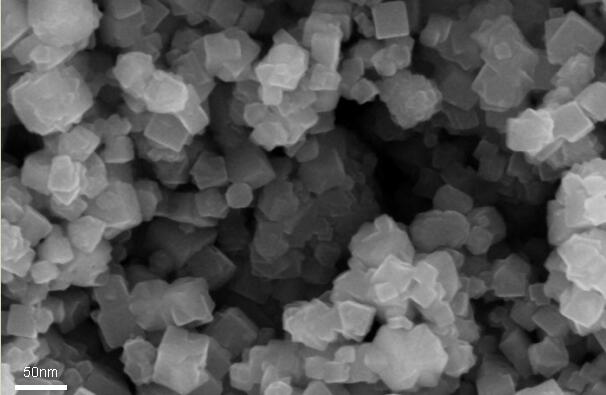

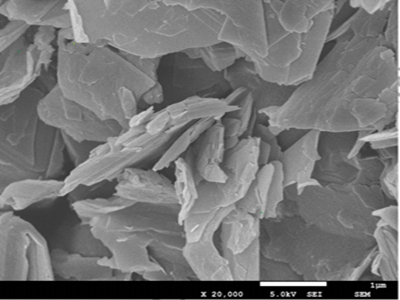

Scanning Electron Microscope (SEM)

Scanning electron microscopy imaging uses a finely focused high-energy electron beam to excite various physical signals on the surface of a sample, such as secondary electrons, backscattered electrons, etc. These signals are detected by corresponding detectors, and the intensity of the signals corresponds to the surface morphology of the sample. Therefore, point by point imaging can be converted into video signals to modulate the brightness of the cathode ray tube to obtain a 3D image of the surface morphology of the sample. Due to the smaller wavelength of the electron beam, it is possible to observe the fine features/details of the material to a greater extent. At present, scanning electron microscopy can magnify object images to hundreds of thousands of times their original size, allowing for direct observation of particle size and morphology. The optimal resolution can reach 0.5nm. In addition, after the interaction between the electron beam and the sample, characteristic X-rays with unique energy will be emitted. By detecting these X-rays, the elemental composition of the tested material can also be determined.

Transmission Electron Microscope (TEM)

Transmission electron microscopy projects an accelerated and focused electron beam onto a very thin sample, where the electrons collide with atoms in the sample and change direction, resulting in solid angle scattering. Due to the correlation between the scattering angle and the density and thickness of the sample, images with different brightness and darkness can be formed, which will be displayed on the imaging device after magnification and focusing.

Compared with SEM, TEM uses CCD to directly image on fluorescent screens or PC screens, allowing for direct observation of the internal structure of materials at the atomic scale, with a magnification of millions of times and higher resolution, with an optimal resolution of<50pm. However, due to the need for transmitted electrons, TEM usually has high requirements for the sample, with a thickness generally below 150nm, as flat as possible, and the preparation technique should not produce any artifacts in the sample (such as precipitation or amorphization). At the same time, transmission electron microscopy (TEM) images are 2D projections of the sample, which increases the difficulty for operators to interpret the results in some cases.

2、 Laser particle size analysis method

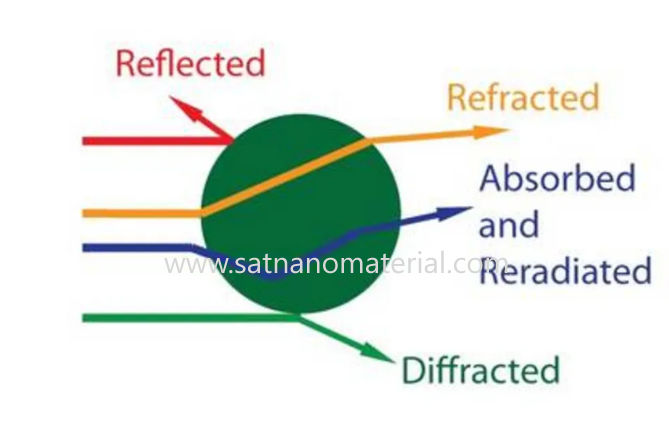

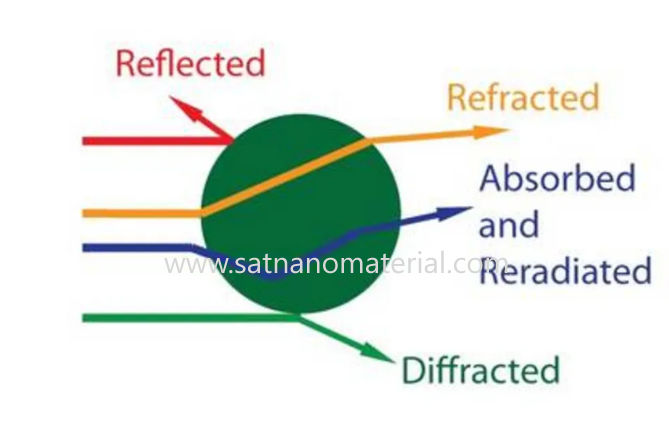

Laser particle size analysis method is based on Fraunhofer diffraction and Mie scattering theory. After laser irradiation on particles, particles of different sizes will produce varying degrees of light scattering. Small particles tend to scatter light in a wide angle range, while large particles tend to scatter more light in a smaller angle range. Therefore, the particle size distribution can be tested by analyzing the phenomenon of diffraction or scattering of particles. At present, laser particle size analyzers are divided into two categories: static light scattering and dynamic scattering.

Static light scattering method

Static light scattering method is a measurement method that uses a monochromatic, coherent laser beam to irradiate a non absorbing particle solution along the incident direction. A photodetector is used to collect signals such as the intensity and energy of the scattered light, and the information is analyzed based on the scattering principle to obtain particle size information. Due to the fact that this method obtains instantaneous information in one go, it is called static method. This technology can detect particles ranging from submicron to millimeter sized, with an ultra wide measurement range, as well as many advantages such as fast speed, high repeatability, and online measurement. However, for agglomerated samples, the detection particle size is usually too large. Therefore, using this technology requires high dispersion of the sample, and dispersants or ultrasonic boxes can be added to assist in sample dispersion. In addition, according to the Rayleigh scattering principle, when the particle size is much smaller than the wavelength of the light wave, the particle size no longer affects the angular distribution of the relative intensity of the scattered light. In this case, static light scattering method cannot be used for measurement.

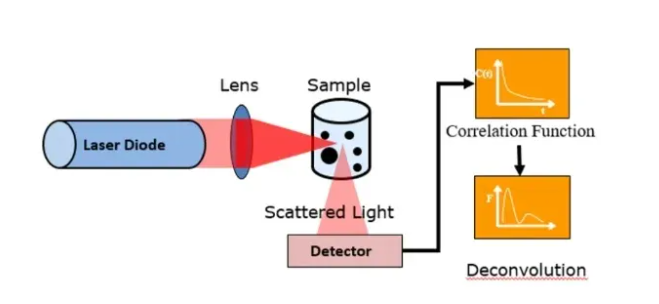

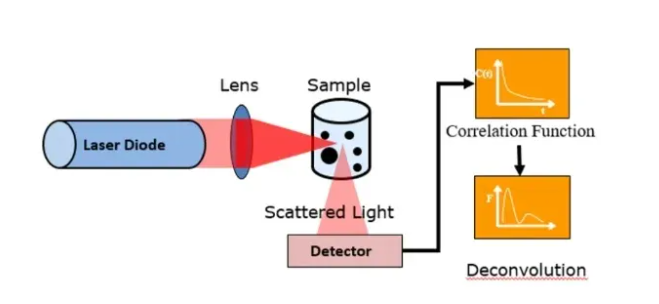

Any particle suspended in a liquid will continuously undergo irregular motion, known as Brownian motion, and the intensity of its motion depends on the size of the particle. Under the same conditions, the Brownian motion of large particles is slow, while that of small particles is intense. The dynamic light scattering method is based on the principle that when particles undergo Brownian motion, the total intensity of scattered light will fluctuate and the frequency of scattered light will shift, thus achieving particle size measurement by measuring the degree of attenuation of the scattered light intensity function over time.

3、 X-ray diffraction broadening method (XRD)

When a high-speed electron collides with a target atom, the electron can knock out an electron on the K layer inside the nucleus and create a hole. At this time, the outer electron with higher energy transitions to the K layer, and the released energy is emitted in the form of X-rays (K-series rays, where electrons transition from the L layer to the K layer called K α). Typically, unique diffraction patterns can be generated based on factors such as material composition, crystal form, intramolecular bonding mode, molecular configuration, and conformation.

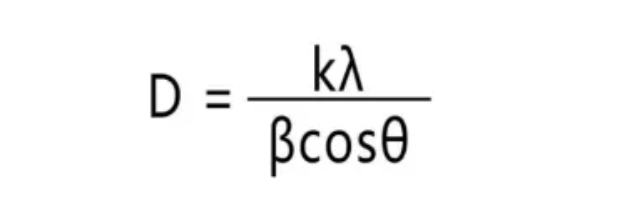

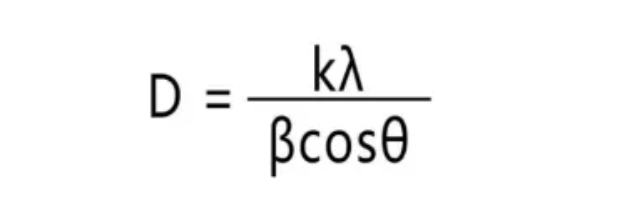

According to Xie Le's formula, the size of grains can be determined by the degree of broadening of X-ray diffraction bands. The smaller the grain, the more diffuse and broadened its diffraction lines will become. Therefore, the width of diffraction peaks in X-ray diffraction patterns can be used to estimate the crystal size (grain size). Generally speaking, when the particles are single crystals, this method measures the particle size. When the particles are polycrystalline, this method measures the average grain size of individual grains that make up a single particle.

Xie Le formula (where K is Xie Le constant, usually 0.89, β is diffraction peak half width height, θ is diffraction angle, and λ is X-ray wavelength)

In summary,

Among the three commonly used detection methods, electron microscopy can provide intuitive images of particles and analyze their particle size, but it is not suitable for rapid detection. The laser particle size analysis method utilizes the light scattering phenomenon of particles, which has the advantages of speed and accuracy, but requires high requirements for sample preparation. The X-ray diffraction linewidth rule is not only used to measure the grain size of nanomaterials, but also provides comprehensive phase and crystal structure information, but it is more complex for material analysis of large-sized grains.